CDJ Insights

Uncovering the latest trends and insights in music and technology.

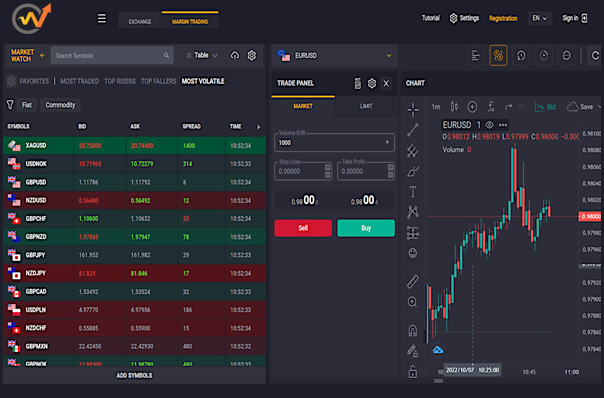

Dollars and Sense: Navigating the Wild World of Forex Trading

Unlock the secrets of Forex trading! Join us at Dollars and Sense to master the market and boost your profits today!

Understanding Currency Pairs: The Foundation of Forex Trading

Understanding currency pairs is crucial for anyone looking to delve into the world of Forex trading. In Forex, currencies are traded in pairs, such as EUR/USD or USD/JPY. The first currency listed is known as the 'base currency,' while the second is the 'quote currency.' A trader buys a currency pair expecting that the base currency will strengthen against the quote currency. For instance, if you believe that the Euro will appreciate against the Dollar, you will buy the EUR/USD pair. This foundational knowledge is essential, as the dynamics of currency pairs influence trading decisions and potential profit margins.

Currency pairs are typically classified into three categories: major pairs, minor pairs, and exotic pairs. Major pairs include the most widely traded currencies, predominantly featuring the US Dollar, such as GBP/USD. Minor pairs are those that do not involve the USD, like EUR/GBP. On the other hand, exotic pairs consist of a major currency paired with a currency from a developing economy, for instance, USD/THB (Thai Baht). Understanding these classifications helps traders better manage their risk and develop strategies tailored to the specific characteristics of each currency pair.

Top Strategies for Successful Forex Trading: Tips from the Pros

Successful Forex trading requires a blend of knowledge, discipline, and strategy. One of the top strategies employed by professional traders is to develop a solid trading plan. A well-structured trading plan outlines your goals, risk tolerance, and specific entry and exit points. According to Investopedia, having a trading plan minimizes emotional decision-making and keeps you focused on your strategy during high-pressure situations.

Another effective strategy is risk management. This means setting stop-loss orders and taking profits at planned levels to protect your capital. As emphasized by BabyPips, controlling your losses is crucial for long-term success in Forex trading. Professionals often recommend risking no more than 1-2% of your trading capital on a single trade to ensure you can withstand a series of losses without significant impact on your account balance.

What Makes Forex Markets Move? Key Factors Every Trader Should Know

The Forex market is influenced by a myriad of factors that can cause fluctuations in currency values. Among the key elements, economic indicators such as GDP growth, unemployment rates, and consumer confidence play a crucial role in determining currency strength. For instance, a country with a robust economy often sees a stronger currency due to increased investor confidence. Additionally, geopolitical events, including elections, trade negotiations, and international conflicts, can lead to sudden market volatility. Traders need to stay informed about these events to make timely trading decisions.

Another significant factor that governs the movement of Forex markets is central bank policies. Central banks such as the Federal Reserve or the European Central Bank have the ability to influence currency value through interest rate changes and monetary policy announcements. For example, a rise in interest rates can attract foreign capital, leading to an appreciation of the currency. Furthermore, market sentiment and technical analysis also play vital roles in currency fluctuations, as traders react to trends and patterns observed in price movements. Understanding these factors is essential for successful trading in the dynamic Forex market.