CDJ Insights

Uncovering the latest trends and insights in music and technology.

Don't Let Your Stuff Become a Mystery: Why Renters Insurance is a No-Brainer

Protect your belongings like a pro! Discover why renters insurance is essential and keep your stuff safe from unexpected surprises.

The Hidden Risks of Renting: Why You Need Renters Insurance

Renting a home or an apartment often feels like a hassle-free arrangement, but it comes with its own set of hidden risks that many tenants overlook. While landlords typically have insurance to cover the building itself, renters insurance is essential for protecting your personal belongings. Without it, you could be left vulnerable to unexpected events such as theft, fire, or water damage, which can result in significant financial loss. Imagine coming home to find that your valuables have been stolen or damaged - without coverage, you may have no recourse to replace them.

Moreover, renters insurance not only protects your possessions but also provides liability coverage in case of accidents that occur within your rented space. For example, if a guest suffers an injury in your apartment, renters insurance can help cover legal fees and medical expenses, safeguarding you from potentially devastating financial repercussions. In a world where uncertainties loom large, investing in renters insurance is not only a smart decision, but a necessary step toward securing your peace of mind while renting.

5 Common Misconceptions About Renters Insurance Explained

Renters insurance is often misunderstood, leading to several common misconceptions that can leave renters unprotected. One prevalent myth is that landlords have insurance that covers tenants' personal belongings. In reality, while landlords are responsible for insuring the physical structure of their properties, this does not extend to tenants’ possessions. If a fire or theft occurs, tenants could face substantial out-of-pocket expenses without their own renters insurance to fall back on.

Another misconception is that renters insurance is too expensive. Many believe they cannot afford the additional premium on top of their rent. However, the truth is that renters insurance is quite affordable, often costing less than a few cups of coffee per month. According to industry standards, it can provide substantial coverage for personal belongings, liability, and additional living expenses in case of unforeseen events. This makes it a small price to pay for peace of mind and financial security.

How Renters Insurance Can Protect Your Belongings from the Unexpected

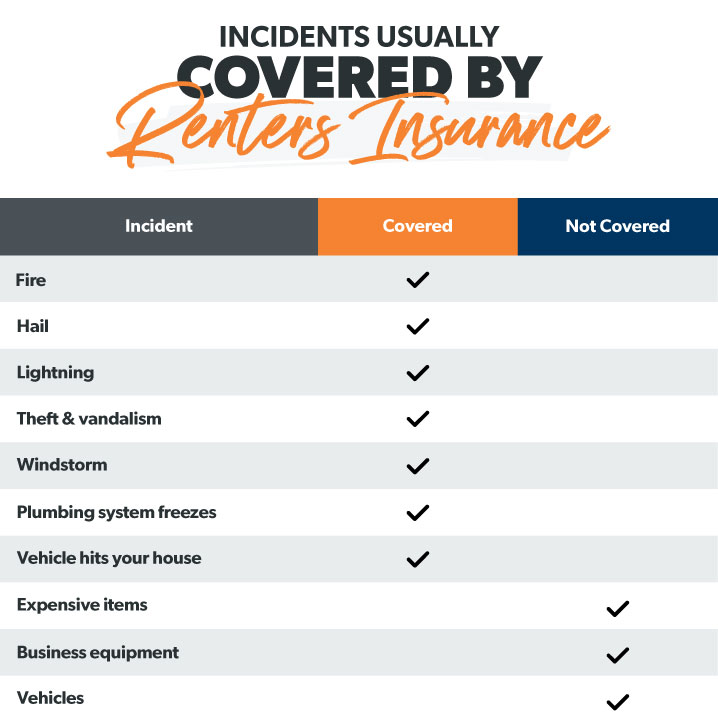

Renters insurance is a vital safeguard for anyone renting a home or apartment, providing crucial coverage for personal belongings against unforeseen events. Whether it’s a fire, theft, or natural disaster, these incidents can leave renters facing significant financial loss. With renters insurance, you can rest easier knowing that your possessions are protected. This type of policy typically covers personal property, liability, and additional living expenses, ensuring you have support during tough times.

Moreover, renters insurance offers peace of mind. Imagine returning home to find your valuables stolen or damaged. Without insurance, replacing these items can be a financial burden. By investing in renters insurance, you are effectively protecting your belongings and securing your financial future. Additionally, many policies include unexpected occurrences such as vandalism or water damage, making it an essential consideration for every renter. Overall, renters insurance is not just a precaution but a smart strategy to safeguard what matters most.