CDJ Insights

Uncovering the latest trends and insights in music and technology.

Discounts on Wheels: How to Drive Down Your Auto Insurance Costs

Unlock the secrets to slashing your auto insurance costs! Discover top tips and tricks to save big while you drive.

Top 5 Ways to Lower Your Auto Insurance Premiums

If you're looking to save money on your auto insurance premiums, you're not alone. Many drivers are searching for effective strategies to reduce their costs without sacrificing coverage. Here are the top 5 ways to lower your auto insurance premiums:

- Shop Around: It's essential to compare quotes from multiple insurance providers. Rates can vary significantly between companies, so using a site like Bankrate can help you find the best deal.

- Increase Your Deductible: Opting for a higher deductible can lower your monthly premiums. Just ensure that you can afford to pay the deductible if you file a claim.

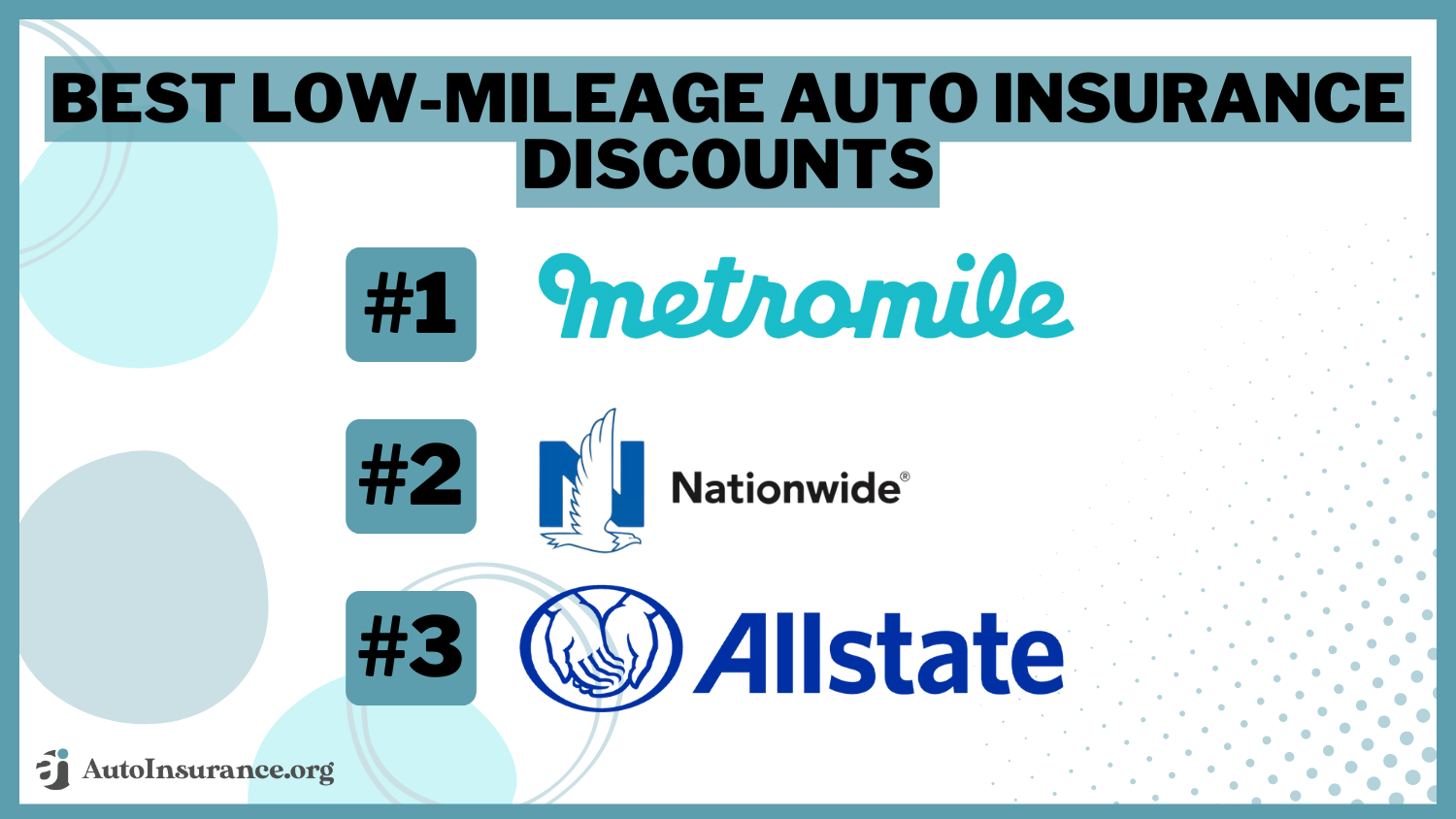

- Take Advantage of Discounts: Many insurers offer discounts for various reasons, such as having a safe driving record or bundling policies. Check with your provider, or visit NAIC for more information on available discounts.

- Maintain a Good Credit Score: Insurers often consider your credit score when calculating premiums. Improving your credit can lead to lower rates.

- Review Your Coverage Regularly: As your life changes, so might your insurance needs. Regularly reviewing your policy can help you identify any unnecessary coverages that can be eliminated to save you money.

Understanding the Factors That Affect Your Car Insurance Rates

Understanding the factors that affect your car insurance rates is crucial for drivers looking to save money while ensuring adequate coverage. Several key elements influence how insurers calculate your premium, including your driving history, the type of vehicle you drive, and your location. For instance, if you have a history of accidents or traffic violations, your rates may increase, as insurers perceive you as a higher risk. Similarly, cars that are more expensive to repair or are frequently stolen tend to attract higher premiums.

Moreover, your credit score plays a significant role in determining your car insurance rates. Insurers often use credit scores as a predictive measure of risk; individuals with lower credit scores may face higher premiums. Additionally, demographic factors such as age, gender, and marital status can also impact your rates. Young, unmarried males typically face higher rates due to statistical risk factors, whereas married individuals might enjoy lower premiums. By understanding these factors, you can make informed decisions to potentially lower your car insurance costs.

Are You Paying Too Much for Auto Insurance? Tips to Find the Best Deals

Are you wondering if you’re paying too much for auto insurance? Many drivers don’t realize that their premiums could be significantly lower with just a few adjustments. First, it’s essential to regularly compare quotes from multiple insurance providers. Websites like ValuePenguin offer tools to help you assess your options quickly. Additionally, consider factors such as your driving record, the type of vehicle you drive, and available discounts. Taking a little time to research can lead to substantial savings.

Another effective way to find the best deals on auto insurance is by reviewing your coverage needs. According to experts at J.D. Power, many individuals carry coverage that exceeds their needs, leading to unnecessary costs. Evaluate your policy and determine if options like raising your deductible or eliminating unnecessary coverage could cut costs. Moreover, don’t forget to ask for discounts – bundling policies, safe driving discounts, and even affiliations with certain groups can help you save. Remember, a little effort can lead to big savings!