CDJ Insights

Uncovering the latest trends and insights in music and technology.

Why Insurance Quotes Are the Secret Sauce to Saving Big

Uncover the hidden savings in insurance quotes and learn how to keep more money in your pocket with savvy comparisons.

Unveiling the Secrets: How Insurance Quotes Can Save You Hundreds

In today's competitive insurance market, comparing insurance quotes has become essential for savvy consumers looking to save money. Simply requesting a quote from one provider may leave you at risk of overpaying for your coverage. By utilizing online tools and services, you can obtain multiple quotes in minutes, allowing you to evaluate the differences in premiums and coverage options. This approach can potentially save you hundreds of dollars each year. For more insights on how to navigate these options effectively, visit Investopedia.

Not only do insurance quotes offer a side-by-side comparison of costs, but they can also reveal hidden benefits and discounts that you may not otherwise be aware of. For instance, some insurers provide lower rates for bundling policies or for maintaining a clean driving record. By taking the time to explore various quotes, you can leverage these factors to negotiate better terms with potential providers. To understand more about maximizing your insurance savings, check out this guide from NerdWallet.

The Power of Comparison: Why You Should Get Multiple Insurance Quotes

When it comes to securing your financial future, getting multiple insurance quotes is a crucial step that often goes overlooked. Many individuals settle for the first quote they receive, unaware that prices and coverage options can vary significantly among providers. By taking the time to compare quotes from different insurers, you can uncover better rates and identify the best coverage tailored to your specific needs. According to a report by NAIC, consumers who compare multiple options often save hundreds of dollars annually on their premiums.

In addition to cost savings, comparing insurance quotes allows you to assess the quality of service and coverage offered by various companies. Each insurer has its own strengths and weaknesses, and evaluating multiple insurance quotes can provide insights into customer satisfaction ratings and claims handling processes. Tools such as Policygenius enable you to easily compare policies side by side, ensuring you make an informed decision. With the right approach, you can find a policy that not only fits your budget but also gives you peace of mind.

Are You Overpaying? Discover How Insurance Quotes Lead to Better Rates

If you've ever wondered, Are you overpaying for your insurance, you're not alone. Many people fail to realize that insurance quotes can play a crucial role in finding better rates. By obtaining multiple quotes from different insurance providers, you can easily compare premiums, coverage limits, and policy features. This process not only helps you identify potential savings but also ensures that you are getting the best value for your money. A great resource for understanding how to compare these quotes effectively is Consumer Reports, which offers tips on what to look for and how to negotiate better rates.

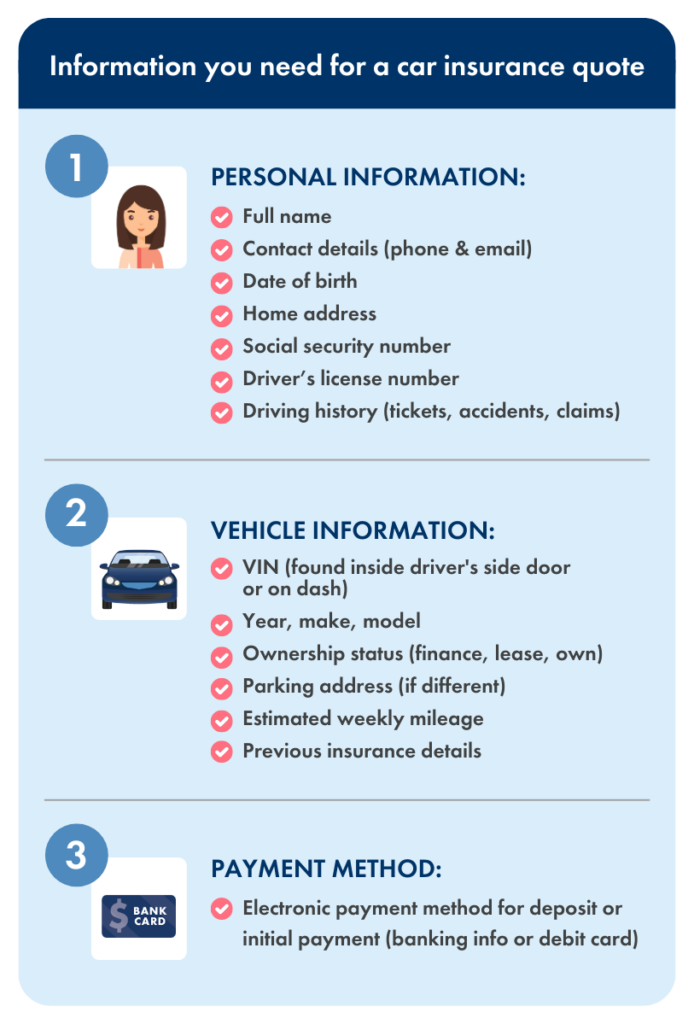

Moreover, shopping for insurance quotes has become easier than ever with the advent of online comparison tools. These platforms allow you to input your details just once and receive quotes from multiple insurers simultaneously. This not only saves time but also provides you with a clearer picture of market rates. Remember, even a slight difference in premium can add up to significant savings over time. For more information on how to leverage these online tools effectively, check out Nolo, which breaks down the steps to take for an informed decision.