CDJ Insights

Uncovering the latest trends and insights in music and technology.

Offshore Banking Secrets You Wish You Knew Earlier

Unlock hidden offshore banking secrets and discover how to safeguard your wealth like a pro! Don’t miss out on this crucial insider info!

5 Hidden Benefits of Offshore Banking You Need to Know

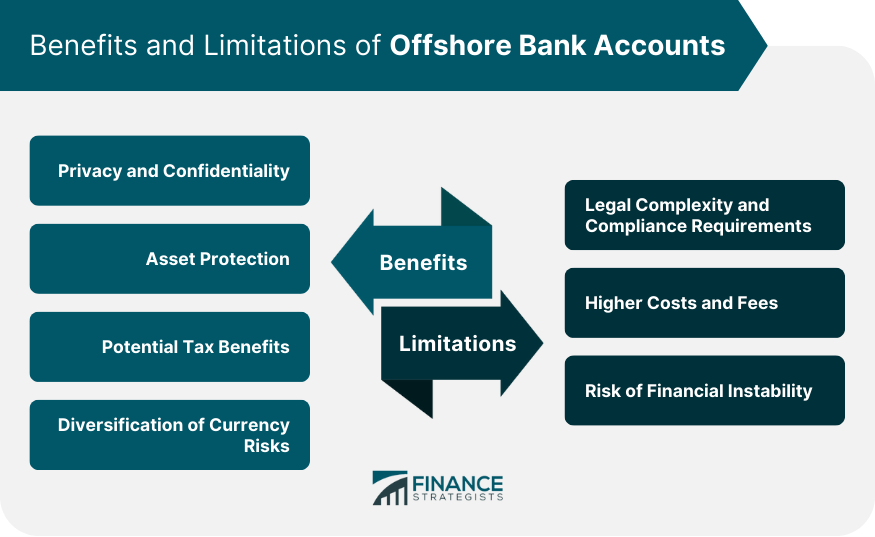

Offshore banking often carries a reputation for being exclusive, but it offers a multitude of benefits that can enhance financial security and flexibility. One major advantage is privacy; many offshore jurisdictions have strict banking secrecy laws that protect your financial information from prying eyes. This is particularly valuable for individuals concerned about identity theft or unwanted scrutiny. Additionally, offshore accounts can provide access to diversified currency options, allowing you to hold multiple currencies and manage currency risk effectively. This can be especially beneficial in times of economic instability.

Moreover, offshore banking can help in tax optimization. While it is crucial to comply with local tax laws, legitimate offshore structures can assist in effective estate planning and tax efficiency. As a result, individuals can strategically manage their wealth to minimize tax liabilities. Furthermore, offshore banks often offer higher interest rates compared to domestic banks, contributing to better savings growth. To learn more about the advantages of offshore banking, you can visit Investopedia for detailed insights.

Is Offshore Banking Right for You? Common Misconceptions Explained

When considering offshore banking, many individuals harbor misconceptions that can cloud their judgment. One common belief is that offshore accounts are only for the wealthy or those looking to hide assets. In reality, offshore banking can provide legitimate benefits for a variety of financial situations, including asset protection, diversification, and access to international markets. For a deeper understanding of these benefits, you can refer to the Investopedia article on offshore accounts.

Another misconception is that opening an offshore bank account is a complex process shrouded in secrecy and legal issues. While there are regulations to comply with, the process has become increasingly straightforward, especially with many banks offering online services. Additionally, the idea that offshore banking is inherently illegal is simply false; transparent offshore banking operations can be fully compliant with tax regulations. For clarity on legal compliance, check out the Forbes guide on offshore banking misconceptions.

Top 10 Countries for Offshore Banking in 2023: What You Should Consider

When considering the top 10 countries for offshore banking in 2023, it is crucial to evaluate various factors that influence your decision. These include financial stability, banking regulations, and tax benefits. Countries like Switzerland, renowned for its strong privacy laws and financial services, consistently ranks high for expatriates and investors. Additionally, jurisdictions such as Singapore offer robust economic environments, making them attractive options for foreign investors and businesses alike.

Moreover, when choosing an offshore banking destination, it's essential to consider the quality of customer service and the variety of services offered. For instance, Hong Kong not only provides competitive interest rates but also a range of investment options that could enhance your financial portfolio. Beyond just accessibility, you should also evaluate the ease of fund transfers and international transactions, which can significantly influence your banking experience. Always remember to conduct thorough research to identify which countries align with your financial goals while ensuring regulatory compliance.