CDJ Insights

Uncovering the latest trends and insights in music and technology.

ETH: The Digital Gold Rush You Didn't Know About

Uncover the secrets of ETH: the digital gold rush that could change your financial future. Don't miss out on this opportunity!

Understanding Ethereum: The Future of Digital Currency

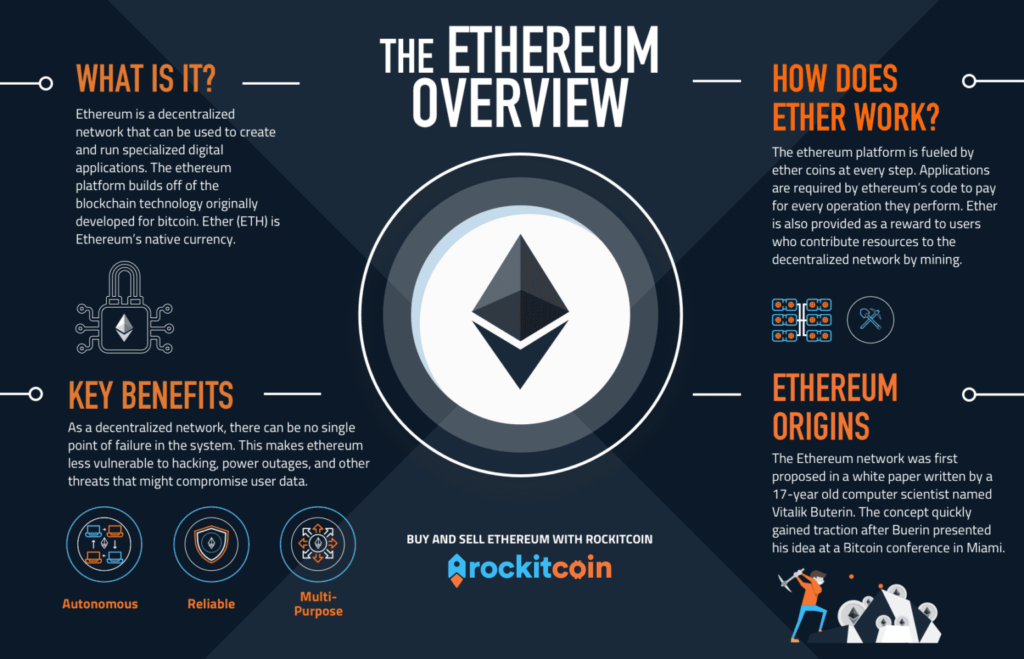

Ethereum is revolutionizing the world of digital currency by introducing a decentralized platform that goes beyond simple transactions. Launched in 2015, Ethereum allows developers to create and deploy smart contracts—self-executing contracts with the terms of the agreement directly written into code. This innovative functionality facilitates a wide range of applications from decentralized finance (DeFi) to non-fungible tokens (NFTs). According to Investopedia, Ethereum's flexibility has made it the go-to blockchain for numerous projects aiming to leverage the power of decentralized technology.

The future of digital currency heavily relies on platforms like Ethereum, as they support increased interoperability and security. With the implementation of Ethereum 2.0, the network aims to enhance scalability and energy efficiency through proof-of-stake mechanisms. This transition is crucial for accommodating the growing number of users and applications on the blockchain. For more insights into Ethereum's potential, check out the detailed analysis on CoinDesk. As we look to the future, Ethereum serves not just as a currency but as a foundational technology that could redefine various industries.

Is Ethereum the New Gold? A Deep Dive into Its Value Proposition

The rise of Ethereum has sparked a heated debate among investors and analysts alike: Is Ethereum the new gold? Often referred to as the backbone of decentralized finance, Ethereum offers a unique value proposition that extends well beyond its initial use as a cryptocurrency. Unlike gold, which has served as a store of value for centuries, Ethereum is built on a robust blockchain platform that enables a myriad of applications, from smart contracts to decentralized applications (dApps). As its ecosystem expands, Ethereum's potential to act as a hedge against inflation and economic instability is increasingly being recognized by many investors. For more insights, you can visit Investopedia.

Moreover, Ethereum's transition to a proof-of-stake model enhances its appeal as a digital asset similar to gold. This upgrade improves energy efficiency and scalability, making Ethereum a more sustainable option compared to traditional financial instruments. Many proponents argue that, much like gold historically served as a portfolio diversifier, Ethereum may fulfill a similar role in a modern investment framework. By incorporating Ethereum into investment strategies, individuals can potentially mitigate risks associated with market volatility. For more information on this transition, explore CoinDesk.

How to Invest in Ethereum: Tips for Navigating the Digital Gold Rush

Investing in Ethereum can be an exciting yet daunting endeavor, especially amidst the growing buzz surrounding cryptocurrencies. To successfully navigate this digital gold rush, start by familiarizing yourself with the fundamentals of Ethereum, a decentralized platform that allows developers to create and deploy smart contracts and decentralized applications (dApps). For a deeper understanding, you can explore resources like Investopedia's Ethereum Guide. Assess your risk tolerance and investment goals before diving in, as the volatility of the crypto market can lead to significant gains or losses.

Once you've studied the landscape, consider starting with Ethereum itself, which can be obtained through cryptocurrency exchanges like Coinbase or Binance. To protect your investment, it's crucial to store your Ethereum securely. Use a reputable wallet—either hardware or software—to safeguard your assets. Additionally, familiarize yourself with market trends and analysis tools. Websites like CoinGecko provide real-time data that can aid in making informed decisions. By following these guidelines, you'll be better equipped to navigate the exhilarating world of Ethereum investing.