CDJ Insights

Uncovering the latest trends and insights in music and technology.

Crypto Chaos: Riding the Rollercoaster of Market Volatility

Navigate the wild world of crypto! Discover tips and tricks to thrive amid market chaos and ride the thrilling waves of volatility!

Understanding Market Volatility: What Causes the Ups and Downs in Crypto?

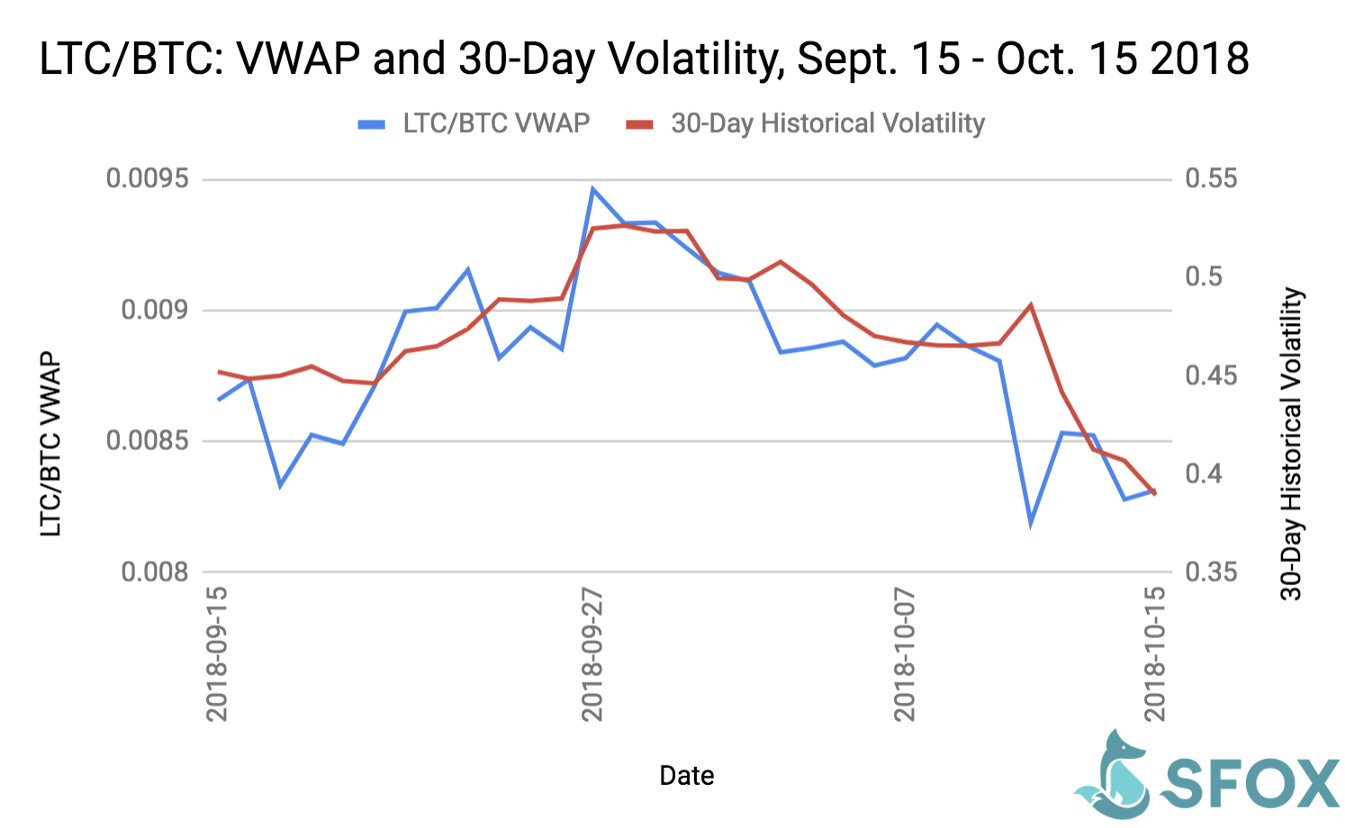

Understanding market volatility in the cryptocurrency realm is essential for investors seeking to navigate its turbulent waters. Unlike traditional markets, crypto assets are affected by a myriad of factors that contribute to their price fluctuations. One significant cause is speculative trading, where investors buy and sell based on sentiment rather than fundamental values. The sheer volume of social media influence and news coverage amplifies these speculations, creating rapid price movements. Additionally, regulatory developments can lead to sudden market reactions as new laws or guidelines are introduced, causing uncertainty and fear among investors.

Another key aspect contributing to crypto's volatility is liquidity. Many cryptocurrencies have a smaller market cap compared to stocks or fiat currencies, meaning that even a modest transaction can significantly impact prices. Furthermore, major events such as hacks or major technological upgrades can disrupt market stability. Understanding these causes is crucial for investors; by being aware of the factors that drive price swings, they can make informed decisions and better manage their exposure to risk in this unpredictable landscape.

Counter-Strike is one of the most iconic multiplayer first-person shooter games, initially developed by Minh "Gooseman" Le and Jess Cliffe. Players compete in teams, typically as terrorists or counter-terrorists, to complete objectives or eliminate the opposing team. For players looking to enhance their gaming experience, using a cloudbet promo code can provide exciting bonuses.

Strategies for Navigating the Crypto Rollercoaster: How to Stay Ahead of Market Swings

Navigating the unpredictable world of cryptocurrency requires both strategic planning and a solid understanding of market dynamics. One effective strategy is to stay informed about market trends and news. Follow reliable sources of information and consider subscribing to newsletters that focus on the latest developments in the crypto space. Additionally, utilizing tools like price alerts and market analysis platforms can help you react quickly to sudden changes. This proactive approach allows you to capitalize on opportunities while minimizing risks associated with volatile price swings.

Another important strategy is to set clear investment goals and risk management parameters. It is wise to diversify your portfolio by investing in a mix of established coins and promising altcoins, as this can reduce the impact of any individual asset's downturn. Use techniques such as stop-loss orders to protect your investments from major losses. Furthermore, taking a long-term perspective can help you resist the temptation to make impulsive decisions based on short-term market fluctuations. By employing these strategies, you can better navigate the crypto rollercoaster and enhance your chances of success.

Is It Time to Panic? A Guide to Managing Emotions During Crypto Turbulence

In the volatile world of cryptocurrency, it’s easy to feel overwhelmed as prices fluctuate and market sentiment shifts. Is it time to panic? The answer typically lies in your emotional response and decision-making process. During turbulent times, it's crucial to take a step back and assess the situation rather than reacting impulsively. Create a plan that includes risk management strategies and remember the importance of maintaining a long-term perspective. Having a well-thought-out approach can help you navigate the storm without succumbing to fear.

Managing your emotions during these downturns is essential for maintaining your investment strategy. Here are a few tips to keep your cool:

- Educate Yourself: Understand market cycles and the factors contributing to price changes.

- Stay Informed: Follow reputable sources for news and analysis to avoid misinformation.

- Connect with Others: Engage with supportive communities or forums to share experiences and strategies.