CDJ Insights

Uncovering the latest trends and insights in music and technology.

Crypto Rollercoaster: How Market Volatility Keeps You on Your Toes

Experience the thrill of crypto market swings! Discover how volatility can boost your trading game and keep you on your toes.

Understanding the Ups and Downs: A Beginner's Guide to Crypto Market Volatility

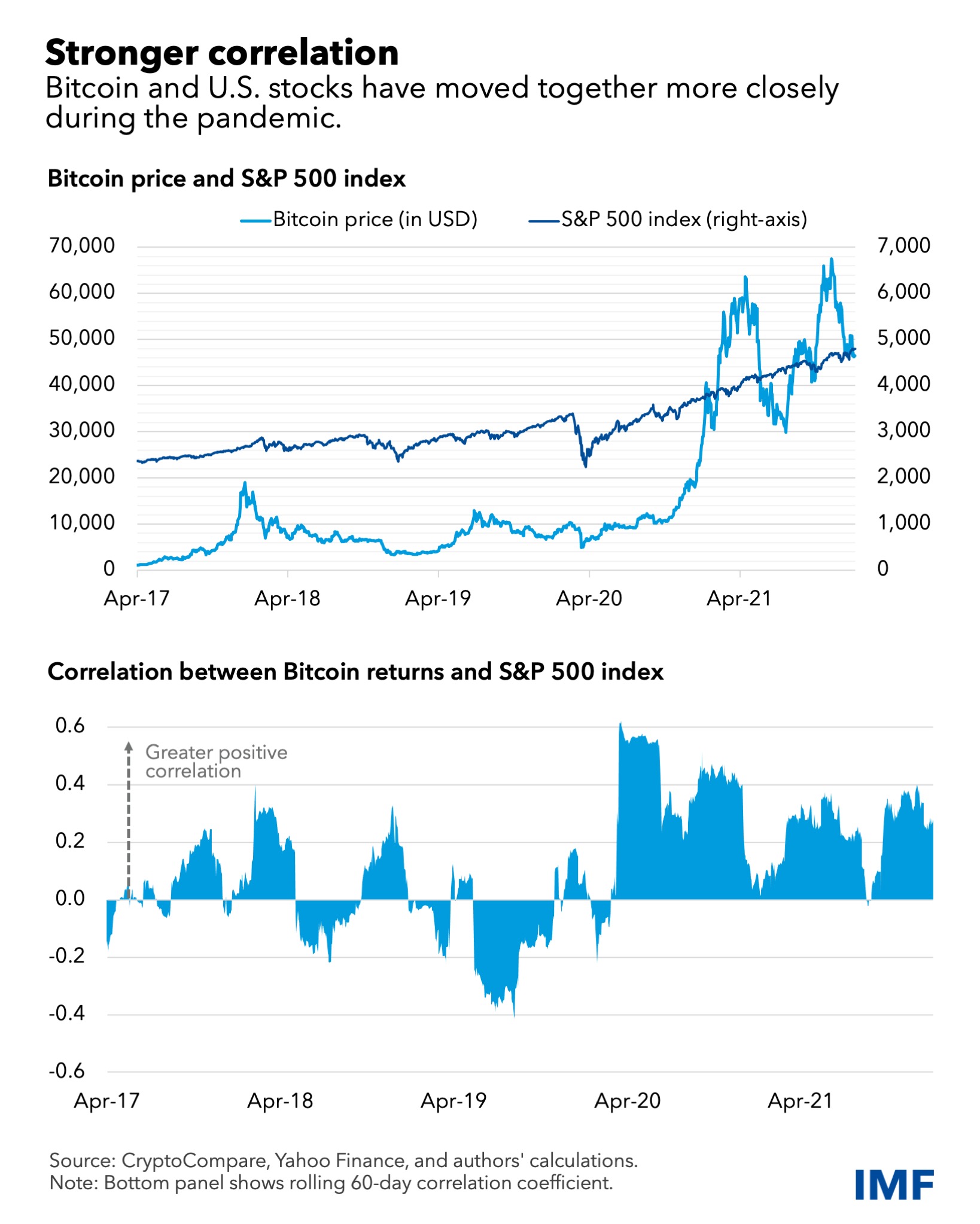

Cryptocurrency market volatility is a defining characteristic that can both excite and intimidate investors. Understanding this fluctuation is crucial for beginners looking to navigate the crypto landscape. Factors such as market sentiment, regulatory news, and technological advancements can cause dramatic price swings in a matter of hours. For instance, Bitcoin's price has experienced highs and lows that can leave new investors feeling overwhelmed. It is essential to recognize that while volatility presents opportunities for profit, it also carries significant risk, which should not be underestimated.

To better grasp the concept of crypto market volatility, consider familiarizing yourself with a few key terms:

- Market Cap: This represents the total value of a cryptocurrency, calculated by multiplying the price by the circulating supply.

- Liquidity: This measures how easily an asset can be bought or sold without affecting its price.

- Bull and Bear Markets: These terms refer to periods of rising (bull) or falling (bear) prices, which can heavily influence market sentiment.

Counter-Strike is a popular tactical first-person shooter game where players join either the terrorist or counter-terrorist team to battle against each other. Many enthusiasts enjoy placing bets on matches and tournaments, and for those interested, using a cloudbet promo code can enhance their gaming experience.

Navigating the Crypto Rollercoaster: Strategies for Managing Investment Risks

Investing in cryptocurrencies can feel like riding a rollercoaster, with prices that can skyrocket one day and plummet the next. To successfully navigate this volatile market, it's essential to adopt effective investment strategies that can help mitigate risks. One fundamental approach is to establish a diversified portfolio. By spreading your investments across multiple cryptocurrencies, you can reduce the impact of a single asset's poor performance on your overall investment. Additionally, consider setting realistic profit targets and stop-loss orders, which can automate your decision-making process during sudden market shifts.

Another effective method for managing risk is to stay informed about market trends and industry developments. Regularly following cryptocurrency news and analysis can help you make informed decisions and adjust your strategies as needed. Utilizing tools like technical analysis and fundamental analysis can provide insights into market movements, enabling you to anticipate potential dips or surges. Furthermore, remember the importance of emotional discipline; avoiding impulsive decisions during price swings can be crucial for long-term success in the crypto market.

What Causes Cryptocurrency Market Fluctuations and How Can You Prepare?

The cryptocurrency market is known for its volatile nature, and several factors contribute to these fluctuations. Firstly, market sentiment plays a crucial role; news events, social media trends, and public perception can lead to significant price changes within a short period. Additionally, the actions of large institutional investors — often referred to as "whales" — can cause sudden market shifts. Supply and demand dynamics also heavily influence prices; for instance, the introduction of a new coin or a reduction in mining rewards can lead to heightened speculation and price changes.

To prepare for the unpredictable nature of the cryptocurrency market, investors should adopt a strategic approach. Here are some tips to consider:

- Diversify your portfolio to minimize risks associated with individual assets.

- Stay informed about market news and trends to make timely decisions.

- Use stop-loss orders to limit potential losses during sudden market downturns.

- Educate yourself on technical analysis and market indicators to identify potential trading opportunities.