CDJ Insights

Uncovering the latest trends and insights in music and technology.

On-Chain Transaction Analysis: The Sherlock Holmes Approach to Blockchain

Unlock the mysteries of blockchain with our Sherlock Holmes-inspired guide to on-chain transaction analysis! Discover hidden insights today!

Understanding On-Chain Transactions: How Data Reveals Blockchain Secrets

Understanding on-chain transactions is crucial for anyone looking to navigate the complexities of the blockchain realm. An on-chain transaction refers to any transaction that occurs on the blockchain itself, with data recorded directly onto the chain. This process is transparent and immutable, allowing users and analysts to examine the transaction history effortlessly. Key features of on-chain transactions include:

- Traceability: Every transaction can be traced back to its origin, ensuring complete transparency.

- Security: Data stored on the blockchain is cryptographically secured, making it incredibly difficult to alter.

- Accessibility: Anyone can access and review transaction records via blockchain explorers, providing a high level of transparency.

By leveraging on-chain data, blockchain enthusiasts and businesses can reveal hidden patterns and trends within the ecosystem. For instance, analyzing transaction volumes can help determine periods of high activity or identify significant market shifts. Moreover, transactions can offer insights into user behaviors, helping businesses tailor their strategies to better serve their audience. Understanding these blockchain secrets empowers users to make informed decisions, whether they're investing or participating in decentralized finance (DeFi) projects. Ultimately, a deeper grasp of on-chain transactions not only demystifies the technology but also enhances trust in its applications.

Counter-Strike is a highly popular tactical first-person shooter game that has captivated millions of players around the world. It emphasizes teamwork and strategy, with players divided into two opposing teams: terrorists and counter-terrorists. Players can enhance their gaming experience through various platforms, and those looking for exclusive offers can find a bc.game promo code to enjoy bonuses and incentives.

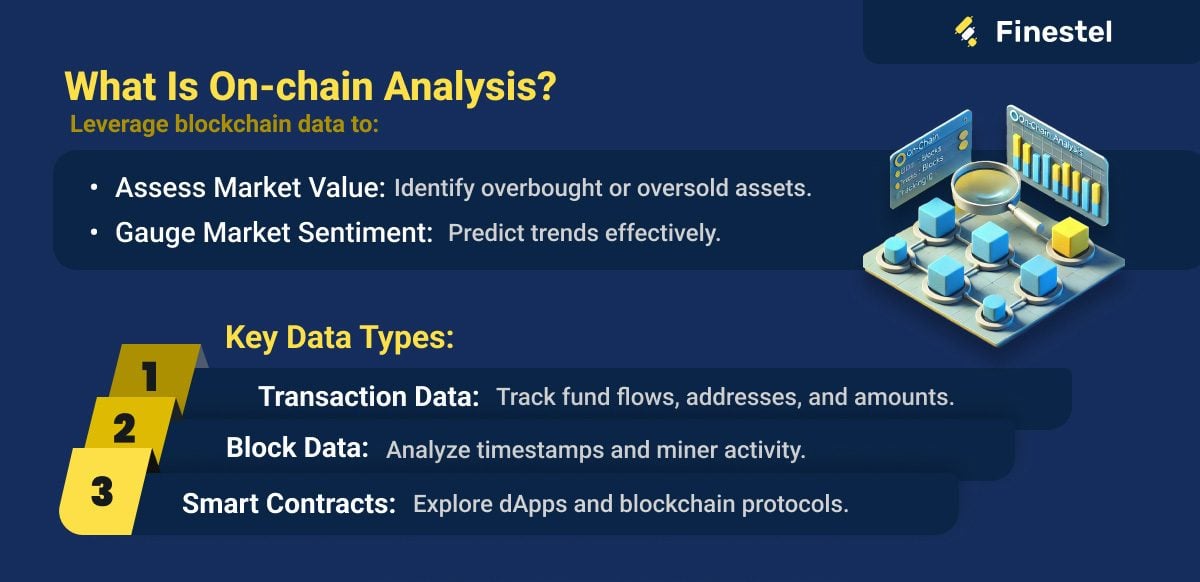

Decoding Blockchain: What On-Chain Analysis Can Tell You About Cryptocurrency Trends

Decoding Blockchain involves diving into the intricacies of on-chain analysis, which offers invaluable insights into cryptocurrency trends. By examining the transaction history, wallet activities, and network metrics, investors can understand the underlying dynamics driving price movements. On-chain data reveals important metrics such as active addresses, transaction volume, and network hash rate, which serve as indicators of market sentiment and potential opportunities. For instance, a surge in active addresses often signals increased interest in a specific cryptocurrency, while unusual spikes in transaction volume can foreshadow significant market shifts.

Moreover, on-chain metrics allow investors to recognize whale movements and assess their potential impact on the market. By tracking large transactions, analysts can gauge whether major players are accumulating or distributing their assets, offering clues on future price actions. Sentiment analysis can also be performed by correlating on-chain data with market news and social media trends. This multi-faceted approach to blockchain analysis not only enhances one’s understanding of current trends but also aids in making informed trading decisions that align with market movements.

How to Use On-Chain Transaction Analysis to Detect Fraud in Digital Currencies

On-chain transaction analysis is a vital tool in the fight against fraud in the realm of digital currencies. By examining transaction data stored on a blockchain, businesses and analysts can gain insights into suspicious patterns that may indicate fraudulent activities. For instance, utilizing blockchain explorers allows one to follow the money trail of transactions, revealing the flow of funds between wallets. This can be critical in identifying irregular behavior such as suddenly increased transaction volumes or transactions going to newly created wallets that lack a substantial transaction history.

To effectively implement on-chain transaction analysis, one should employ a combination of data analysis techniques and tools. Start by categorizing different types of transactions—such as exchanges, private wallets, and smart contracts—to pinpoint anomalies. Afterward, consider employing machine learning algorithms to refine your detection capabilities, as these can quickly process large datasets and identify trends that may indicate fraud. Additionally, engaging with community resources and insights can enhance the understanding of emerging fraud schemes in the ever-evolving landscape of digital currencies.